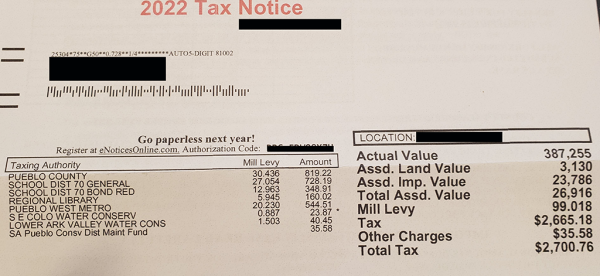

New Pueblo West Land Property Tax Classification

This is one of those times that you could say that government really did cause your property taxes to go up. At least in respects to your vacant land in Pueblo West. According to the Pueblo County Assessor, there were roughly 1300 properties in Pueblo West that were identified an about 1,000 properties were given…

Read the full article…